Nvidia has surpassed Apple and Microsoft to become the world’s most valuable public company.

Nvidia’s stock has seen incredible growth, recently rising 3.2% to $135.18. This has increased its market value to an astounding $3.332 trillion, a far way from its $300 billion valuation just two years before.

The company’s rise from a niche player in gaming graphics to a dominant force in AI technology demonstrates how quickly AI is reshaping the global economy.

Nvidia’s rise can be attributed to its dominant position in the AI chip market. The company controls approximately 80% of the market for AI chips used in data centers. Tech companies like Google, Microsoft, Amazon, and Meta have been using Nvidia’s processors to develop and run large AI models.

Nvidia’s latest “Hopper” series of GPUs has been particularly popular, reinforcing its leadership in this space.

In the most recent quarter, Nvidia’s data center business saw a 427% revenue increase over the previous year, reaching $22.6 billion. This segment now accounts for approximately 86% of the company’s total sales, demonstrating the critical role AI plays in its growth.

Their overall financial performance is impressive, with a 265% year-on-year revenue increase in February and a 262% increase in May.

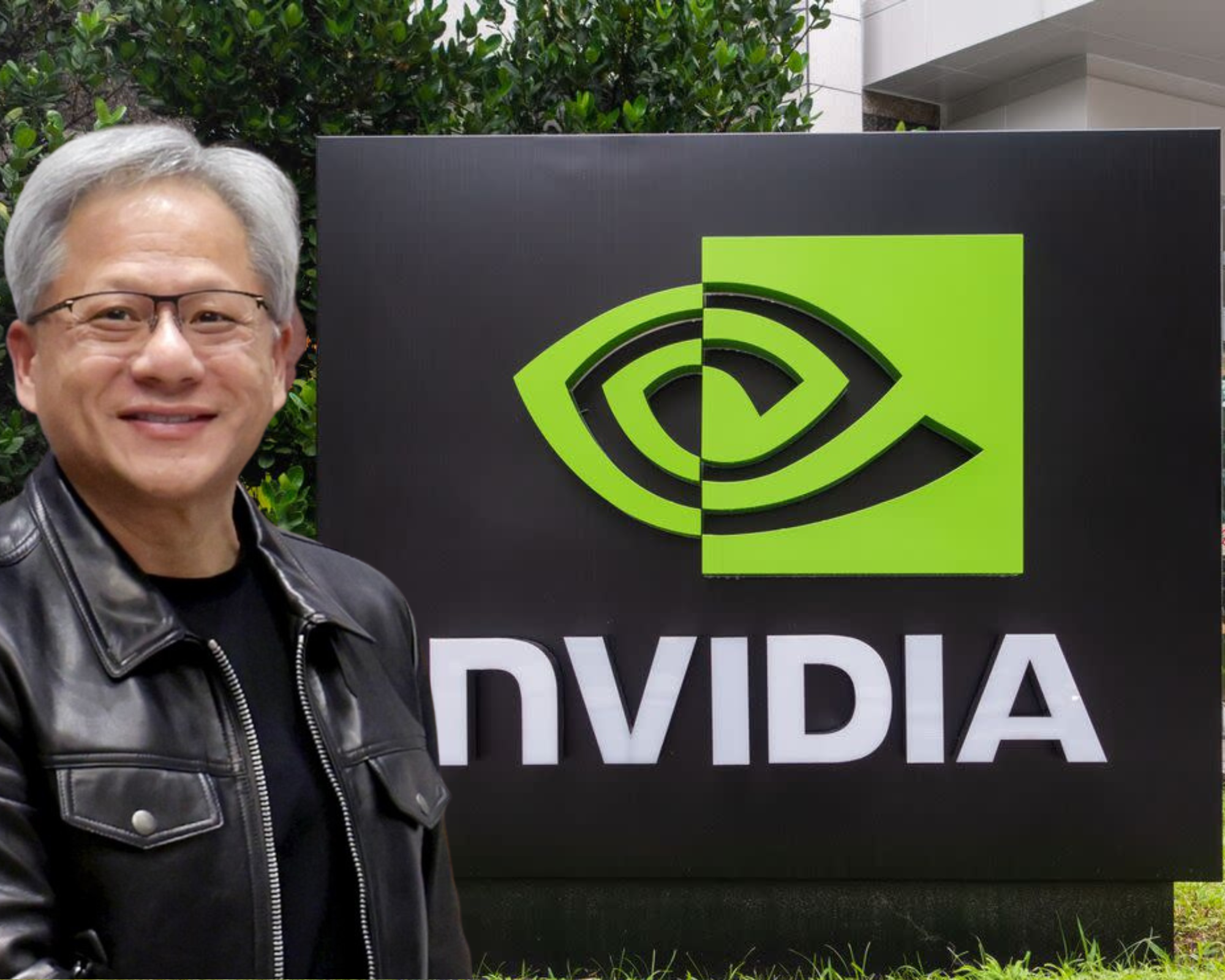

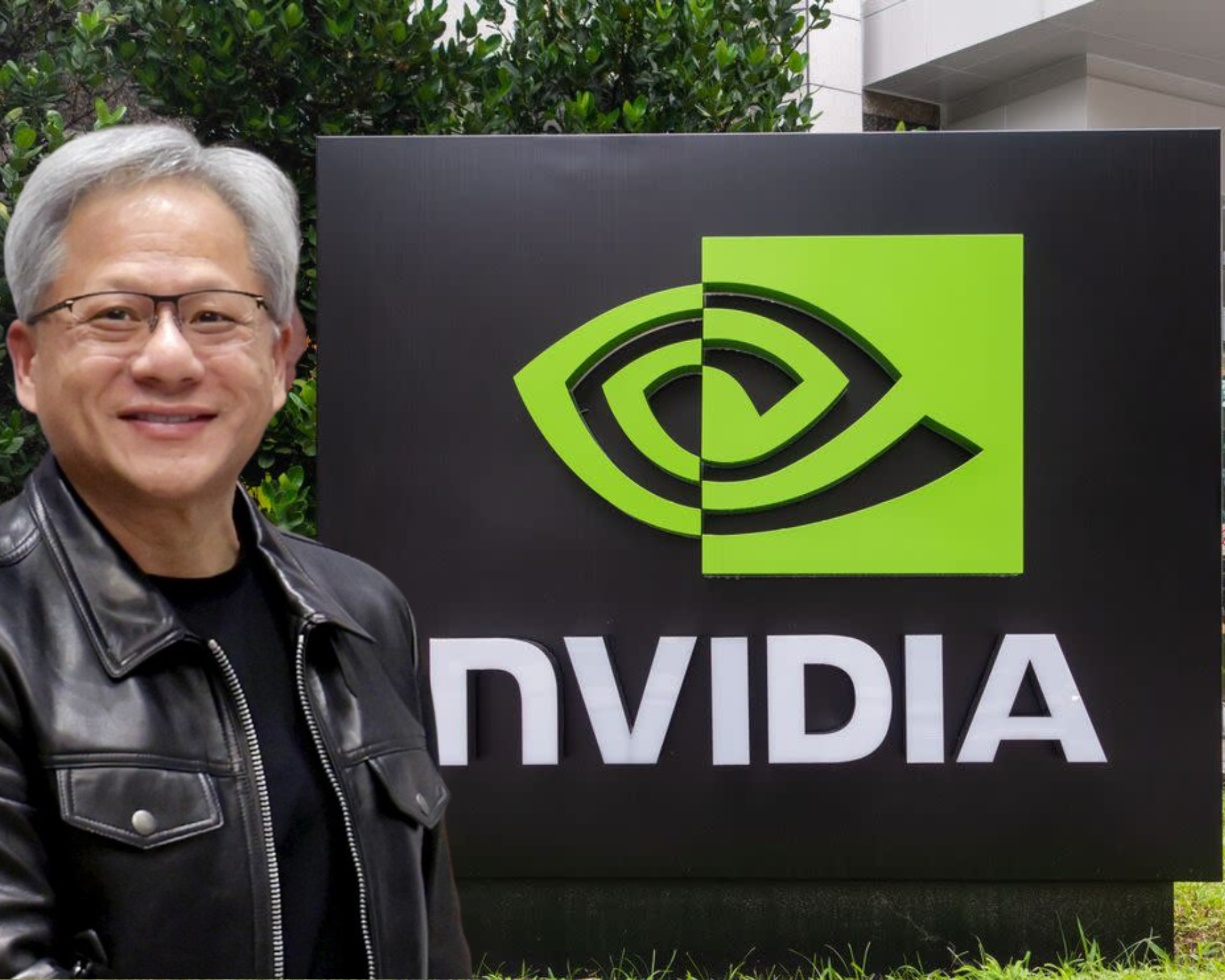

Nvidia’s CEO, Jensen Huang, has been a visionary leader constantly pushing the boundaries of AI technology. His claim that Nvidia is at the forefront of a new revolution is supported by the company’s AI advancements, which are expected to transform a variety of industries, including healthcare and finance.

Cuda, Nvidia’s software ecosystem provides developers with the tools they need to fully utilize the power of its chips. This has created a cycle of adoption and innovation, keeping Nvidia ahead of competitors like AMD and Intel, who are also vying for a piece of the AI chip market.

Its stock alone has driven a large part of the year-to-date increase in the S&P 500 index. Their recent performance also triggered a massive $23 billion trade in State Street’s Technology Select Sector SPDR ETF (XLK), reflecting its growing influence in the tech sector.

A diversification rule in the ETF has limited the concentration of the fund, resulting in a planned rebalancing that will involve buying more Nvidia stock and selling some Apple shares.

For over a decade, Apple and Microsoft have been the most valuable companies in the US, and often the world.

Huang’s net worth has risen to around $117 billion, making him one of the wealthiest individuals globally.

As Nvidia continues to roll out its next-generation “Blackwell” chips and expand its AI capacity. This impressive rise not only highlights Nvidia’s success but also the impact AI is having across various industries worldwide.

If you liked this story, please follow us and subscribe to our free daily newsletter.